The Complete Guide to Collecting Expired Credit Cards

Just like other hobbies, credit card collecting requires dedication, practice, and patience. A lot of time, effort, and joy can go into searching for the right credit cards, and serious collectors have amassed thousands during the course of their hobby.

It also entails monetary investment if you want to own some of the rarest and most sought-after vintage credit cards, especially those that have historical value or were once owned by famous people. It may seem odd to non-collectors, but the satisfaction you’ll get from completing (or almost completing – we’ve yet to meet a credit card hobbyist whose set is complete) your set of rare and valuable credit cards is worth all the effort and money you’ll spend.

Credit Card Collecting as a Hobby

Collecting credit cards is a relatively new and rare hobby – some might say unusual. Out of the 2.8 billion credit card users in the world, perhaps only a few thousand collect expired credit cards as a hobby. Coin collectors vastly outnumber those who collect old credit cards.

Collecting credit cards is a relatively new and rare hobby – some might say unusual. Out of the 2.8 billion credit card users in the world, perhaps only a few thousand collect expired credit cards as a hobby. Coin collectors vastly outnumber those who collect old credit cards.

People who are truly passionate about credit card collecting find it rewarding in many ways. Some are interested in it because of the history, culture, and society that credit cards from various eras or countries represent. Others are fascinated by the aesthetics of the various designs, or by how credit card technology has evolved over the decades. There are also collectors who particularly love the rarity of vintage credit cards, especially if they bear the names of celebrities or historical figures.

On the other hand, there are those whose enjoyment goes beyond the act of collecting credit cards, and extends into the social aspects of potentially making connections with those who have similar interests. Some collectors are also enterprising and aim to make a profit by selling their vintage and rare credit cards. Although antique credit cards are still generally less valuable than old coins, you can earn good returns from your credit card collecting hobby. To make the most of this potential, you can learn how to value your old credit cards.

Credit Cards and Numismatics

Credit card collecting can be classified as part of a larger category known as numismatics, or the study and hobby of collecting various forms of currency, including things like:

Credit card collecting can be classified as part of a larger category known as numismatics, or the study and hobby of collecting various forms of currency, including things like:

- Banknotes

- Cheques

- Coins

- Tokens

- Paper money

- Credit cards

- Medals

- Other related payment media

Items that are traded without using a monetary medium, such as in the act of bartering, are not included in numismatics. Neither can currencies from certain cultures be included in the study or collecting of currency, purely because some are too bulky or perishable.

For example, the Kyrgyz people of Kyrgyzstan used horses as their main currency unit, and lambskins as change. While the lambskins are appropriate for numismatic study, the horses, for obvious reasons, are not. For several centuries, various cultures and civilisations have used a wide range of objects as currencies. Some of the common currencies in the past were cowry shells, precious metals like gold, large stones, gemstones, and cocoa beans.

Etymology of the word numismatic

The English word numismatic was first used in 1829 when referring to coins. It’s a borrowed word from the French numismatiques. The complete etymology of the word can be traced back to Latin and Ancient Greek, as follows:

- Numismatiques, derived from the Late Latin numismatis, genitive of numisma, which is a variant of the word nomisma, meaning ‘coin’

- Nomisma (νόμισμα), an Ancient Greek word meaning either current coin or custom. This was derived from:

- Nomizō (νομίζω), which means to hold or own as a custom or usage. This was in turn derived from:

- Nomos (νόμος), which means either usage or custom. Finally, nomos is derived from the Ancient Greek word:

- Nemō (νέμω), which means several things, including: to dispense, divide, assign, keep, hold, allot, or take.

- Nomos (νόμος), which means either usage or custom. Finally, nomos is derived from the Ancient Greek word:

- Nomizō (νομίζω), which means to hold or own as a custom or usage. This was in turn derived from:

The numismatics hobby

The credit card collecting hobby can be classified as a subcategory of numismatics, called “exonumia” in American English and “paranumismatica” in British English. This is the study of coin-like objects, such as tokens, coins, and medals, and other similar objects used either as commemorative items or as legal currency. Some examples, as well as credit cards, are:

- Elongated coins

- Encased coins

- Souvenir medallions

- Tags

- Badges

- Counterstamped coins

- Wooden nickels

However, not all expired credit cards are worth collecting. Indeed, hobbyists are fairly discriminating in their tastes. While it ultimately boils down to personal preference, the hobby of collecting old credit cards has some general standards and categories of collectibles. Collectible cards are usually based on the following categories:

- Age of the card: Older credit cards tend to be considered collectibles, especially those issued at least two decades ago. Just like wine, vintage credit cards tend to fetch at a higher price compared to newer ones

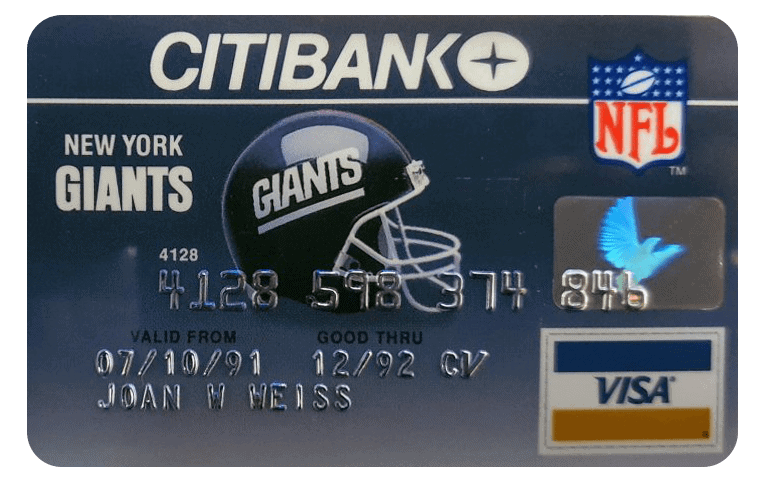

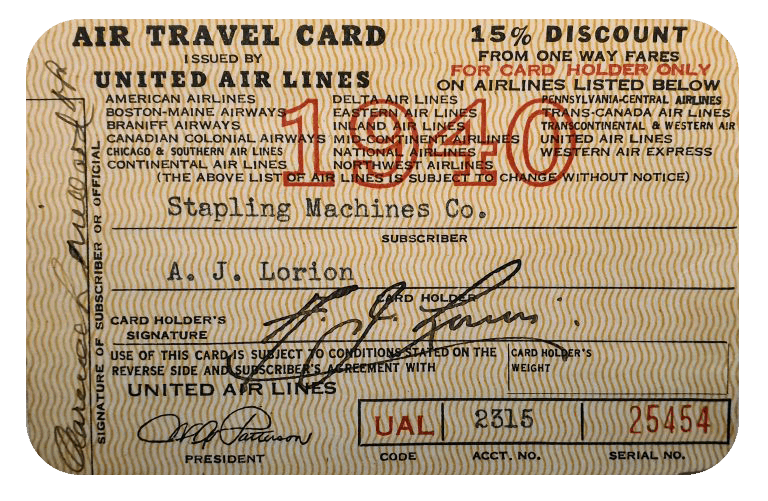

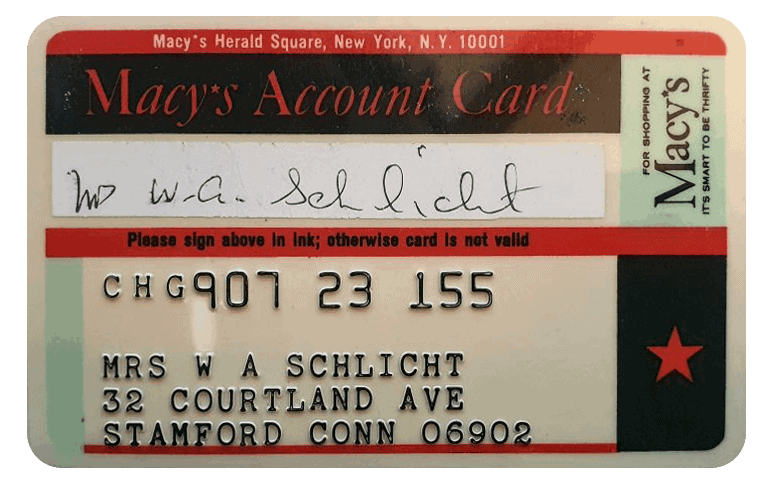

- Type of card: Some of the most common types of credit cards are co-branded cards (issued in conjunction with a for-profit organization), affinity cards (issued in conjunction with a non-profit organization), air travel cards, bank cards, travel and entertainment cards, oil and gas cards, hotel cards and retail cards. Some of these cards have niche markets of collectors who focus on them specifically

- Quality of preservation: Credit cards have not always been made of plastic. In fact, the more antique credit cards were made of thick paper. Unfortunately, it’s an unavoidable fact that as cards get older, they deteriorate. That said, well-preserved cards are typically more valuable than deteriorated ones, even if they’re from the same age

- Historical value: Many credit cards have been found that have belonged to a historical figure, or were once used in an important historical event. For example, some first-issue Diners Club cards from the 1950s have higher historical value than other types of cards because these were one of the first types of credit cards widely used in the US

- Celebrity connection: Cards formerly owned by celebrities, like actors, singers, athletes, and politicians, can fetch more value at auctions. For example, a credit card once owned by Michael Jordan was bought by a fan for US$3,146 in a 2012 auction. Signed cards of celebrities can have an even higher value if they’re authenticated

- Card issuer: Some collectors prefer specific issuers of cards, like an airline company or a bank. They may even trade some of their collected cards for others that have the specific issuers that they prefer. The reason for this is usually the desire to have complete sets for every major or minor card issuer

- Rarity of the card: The value of a collectible expired credit card largely depends on its rarity. Some of the rarest cards include those with historical value or those formerly owned by celebrities

- Aesthetics and design: Some collectors have preferences for specific types of aesthetics and designs, such as the color motif, graphics, and patterns. These elements will drive up the value for these types of collectors

- Previous acquisition price: You can purchase collectibles for your credit card collecting hobby online, especially on eBay. You can also purchase them from friends or fellow collectors. However, you’ll likely pay a higher price than the previous acquisition value of a card because other collectors need to make some kind of profit

Why Are Old Credit Cards Collectible?

Old credit cards are like time capsules that provide interesting information about the time period in which they were issued and used. Some are pieces of history in and of themselves, while others can form part of celebrity memorabilia. Antique credit cards will always be collectible as long as people are interested in keeping them for their own pleasure.

All collectors, whatever type of items they collect, find satisfaction and a sense of achievement in collecting the objects that they like. Just like other collectible items, expired credit cards can be classified into different categories, which are determined by factors like eras, types, issuers, and countries. Some of the reasons why old vintage cards are considered collectibles are:

- Rarity of the cards: Most credit cards are cut up and thrown in the bin when they expire, making it very difficult to find older credit cards. This underpins the thrill of the chase: the older credit cards get, the rarer they become, so owning a 50-year-old or even a 100-year-old credit card may be considered an achievement by collectors

- Historical value: Many of the collectible and valuable antique credit cards provide a historical glimpse at the period from which they’re from. Some are owned by famous figures who made great contributions to society and participated in making history. Meanwhile, other vintage credit cards have historical value because they’re the first of their kind. For example, a Visa credit card issued in 1958 is collectible because this is the year that the Bank of America first launched its consumer credit card program

- Interesting features or design: Even modern credit cards can be collectibles, especially if they have commemorative designs and limited releases. These are particularly valuable because of their interesting features and designs, as well as their exclusivity

- Special purpose cards: Some special purpose cards, such as the Electronic Benefit Transfer card (EBT) for food stamps, are collectible because of their specific use. While they may look like standard credit cards, they have a very specific purpose which can be attractive to certain types of collectors

- Monetary profits: For most collectors, the joy of possessing their most sought-after credit cards is sufficient reward. They’re willing to spend hundreds or even thousands of dollars just to own that vintage credit card that they wanted. However, others may collect as a way of earning money by selling the valuable credit cards that they’ve collected

Expired credit cards may seem worthless to many people, but their value extends well beyond their expiration dates, all thanks to hobbyists who are passionate about credit cards.

A Brief History of Credit Cards

Contrary to the common notion that credit cards are products of modern financial innovations and technology, their origins can actually be traced back to ancient times, when the concept of money was first developed.

Ancient times

The concept of credit cards, or the idea of a line of credit, is almost as old as the concept of money itself. Similar to modern electronic credit cards, clay tablets were used by the Mesopotamian and Harappan civilisations (around 6,000 to 3,700 years ago) to track trade, including debts.

Based on research by Jonathan Mark Kenover, a renowned archaeologist and Professor of Anthropology at the University of Wisconsin, clay tablets with seals were used as a form of credit card to record transactions between these two civilisations and within their own territories. It was necessary to use these tablets in large-volume transactions where using physical money would have been impractical and too cumbersome.

Similarly, records from the Babylonian empire indicate the use of lines of credit by citizens and traders. Written rules about lines of credit were part of the Hammurabi Code. However, these lines of credit were more akin to the modern day concept of a loan rather than a credit card. The really interesting thing about the Babylonian rules is the stipulations around payment delinquencies and fraud, which are similar to modern laws about credit card protection and regulation.

The 1800s

The 1800s

Around five thousand years later, in the 1880s, merchants started issuing credit coins. These coins had the identification number of the customer, with details of (and often an image associated with) the issuing merchant. Over time, more merchants issued charge coins to customers, allowing them to make purchases on credit in their stores. Charge coins continued to be issued until the 1940s and a plethora of coins, of all shapes and sizes, emerged. Many people collect these coins today. A Charge Coin Reference Guide has been authored by members of the American Credit Card Collectors Society (see our publications page for further information about this).

Although the Diners Club card was the first multipurpose charge card (see below), it’s important to note that the current credit card giant, American Express, can trace its origin to the 1800s during the merger of three companies—Wells & Company, Livingston, Fargo & Company, and Wells, Butterfield & Company—on March 18, 1850. The company, however, only began its credit card business in 1958. From the 1800s until the early 1950s, American Express focused on other types of international financial services, like money orders.

By 1868, the American Express and Merchants Union Express companies merged, forming the American Merchants Union Express Company. Then, in 1873, the company was renamed as American Express Company.

American Express also pioneered the issuing of traveller’s checks. The company then expanded to Europe, with its first European office opening in Paris in 1895. Further expansions to England and Germany happened in 1898.

The 1900s to 1940s

In the 1920s, a few department stores and oil companies in the U.S. made an innovation that took credit one step further: they issued proprietary cards called Charge Plates. These were the precursor to modern day store cards that are issued by most retailers. They were intended to promote customer loyalty and improve service because, just like today’s store cards, and charge coins of the past, they were only honored by the store that issued them.

Most historians recognize John Biggins, a banker working at the Flatbush National Bank of Brooklyn, N.Y., for launching the first true credit card, in the modern sense of the word. It was in 1946 that Biggins launched the Charg-It card. Just like the modern credit card, data from every purchase made using the card was forwarded to the bank where Biggins was working. The bank acted as the middleman that reimbursed the merchant. It also collected payment from the customer, with some corresponding fees (interest rates) in the case of delayed payments. Thus, the ‘closed-loop’ financial system of the credit card was created.

The Charg-It card was innovative for its time, but it lacked one key aspect of modern credit cards: it was still very limited in scope because it could only be used locally (it was only valid at merchants within a two block radius of Biggins’ bank). Also, unlike modern credit cards, only customers of the bank could obtain the Charg-It card.

The 1950s

According to Diners Club International, the invention of the Diners Club card was inspired by an incident in the life of Frank McNamara, who forgot his wallet while he was attending a business dinner at New York’s Major’s Cabin Grill in 1949. It was an epiphany moment for him in conceptualising the card.

Several months later, McNamara returned to the restaurant with his business partner, Ralph Schneider. With them they brought a cardboard card and a proposal that led to the creation and debut of the Diners Club Card in 1950.

By 1951, barely a year after the card was introduced to the public, Diners Club cardholders numbered more than 40,000. By 1959, the members reached more than one million. Today, the club boasts more than 189 million cardholders worldwide. However, it still wasn’t quite the same as our current concept of a credit card, the key difference being that with Diners Club cards, the customer needed to pay the entire bill after one month.

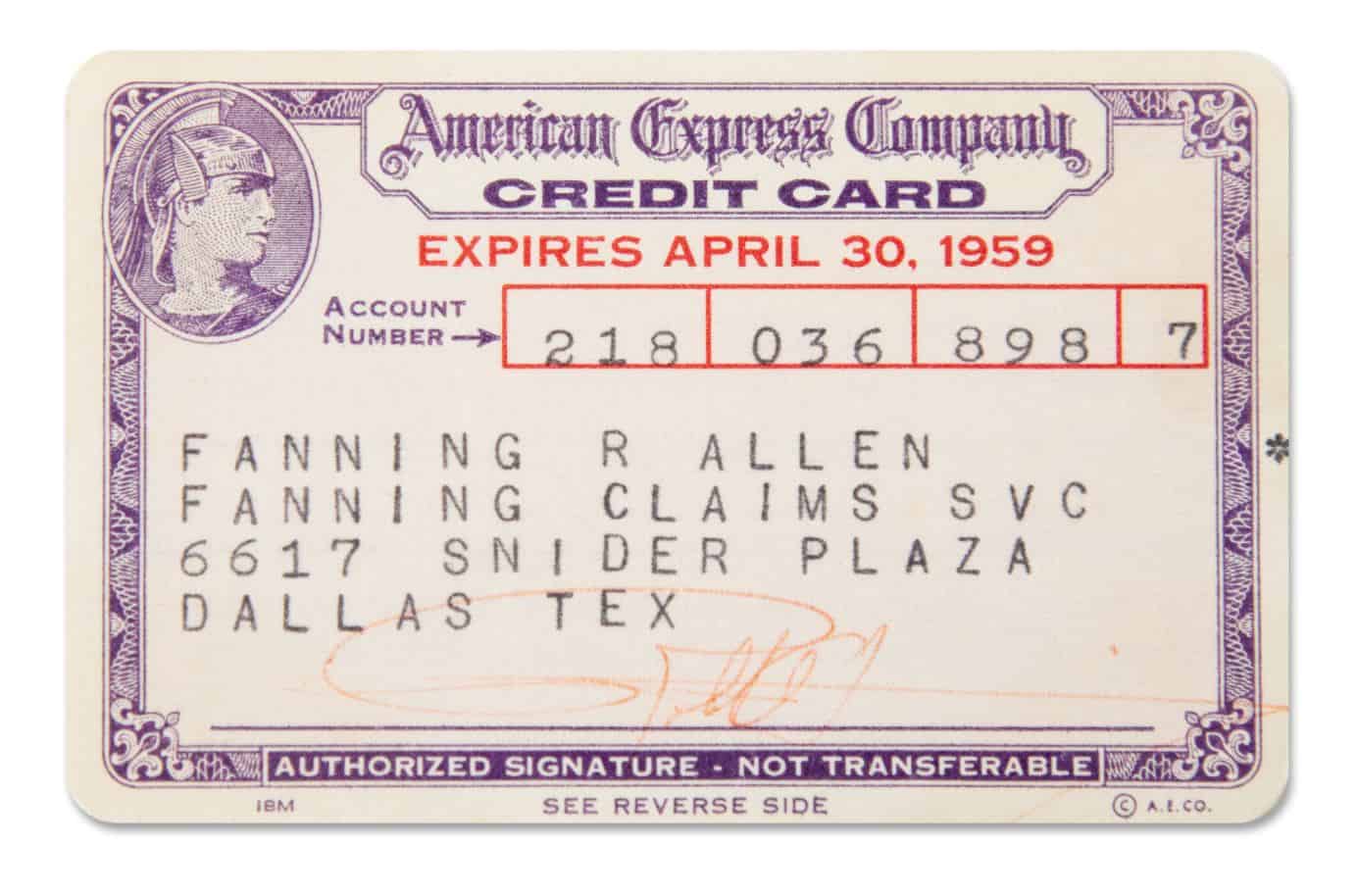

As the Diners Club card was booming, the American Express card was launched in 1958. The concept was similar to the Diners card in being multipurpose, but its historical origin is different, and can be traced back to the company’s charge coin in the 1860s (see above).

The first true modern credit card was the BankAmericard, which later became Visa. It was launched by the Bank of America in 1958. It had a $300 limit and it was the first credit card with revolving credit. Another capability the BankAmericard pioneered was that cardholders were able to carry a balance.

The 1960s to 1970s

The 1960s to 1970s

Early credit cards didn’t have magnetic stripes or EMV chips. Some of them did have mechanical imprints to record and read account data. Magnetic stripes weren’t invented until the early 1960s, when they were used as part of CIA employee IDs. Later in 1969, they became a standard part of paycards, such as debit cards, phone cards, and credit cards.

In the 1970s, the EMV chip was introduced for data storage in paycards. The acronym stands for “Europay, Mastercard, and Visa” in recognition of the three companies that created the standard. However, EMV chips only became standard in 2015.

BankAmericard was rebranded as National BankAmericard, Incorporated in 1970. It was organized as an interbank card association, which issued and managed credit cards. Six years later, the company was once again rebranded, this time as Visa.

Another important credit card company formed during this time was Mastercard, which was incorporated in 1979. Before this, it was The Interbank Card Association, which was formed in 1967. Just a year later, in 1968, it was rebranded as Master Charge before it finally became Mastercard in 1979.

What’s the Oldest Credit Card?

Technically speaking, the oldest credit card in the modern sense is the BankAmericard, launched in 1958 by Bank of America. It had the core features of a modern credit card such as credit limit, multipurpose use, and revolving credit. Some would argue that the Diners Club card is the oldest and first modern credit card, but this is debatable since it was actually a charge card.

Paper Credit Cards

Paper loyalty cards were first used in 1885. Merchants issued these cards exclusively to their customers, and they were honored only in the stores that issued them.

Early charge cards, like the Diners Club card and American Express cards, were also made from paper. The upside was that cardboard or paper credit cards were relatively easy to print. The downside was that they weren’t very durable. Nowadays, this increases their scarcity.

Plastic Credit Cards

The earliest plastic credit cards were issued by BankAmericard (now Visa) in 1958. American Express issued the first plastic credit card in 1959. This is what has eventually become the standard credit card we know today, owing mainly to its durability, since plastics are waterproof and cheap to produce. Magnetic stripes and EMV chips are also easy to integrate with plastic cards.

What Type of Credit Cards Should I Collect?

The type of cards you should collect will totally depend on your personal preferences. You could either collect all types of credit cards, or you could focus on one or more specific types, such as bank cards or gas cards.

Collecting rare special issue or vintage credit cards might be best if you’re looking to turn a profit. Other important factors to consider for profitability are the aesthetics, age, historical value, and condition of the card.

Ultimately, though, the central criterion for choosing the type of credit card to collect depends on your own personal tastes. Whether you want to make money, collect as many types as possible, or become an expert in a particular category, all that matters is that you’re happy with the direction of your credit card collecting hobby (which might change as you discover more about the hobby!).

How Much Do Expired Credit Cards Cost?

Depending on the type of the card, the quality of the card, and whether it has any historical significance or celebrity connection, an antique credit card may fetch a market value between a few dollars to several thousands. For example, a 1970s American Express card owned by Elvis Presley was sold at an auction for US$41,400.

Just like other commodities, the price of collectible credit cards is also determined by supply and demand. It’s primarily about what the buyer is willing to pay. You can also trade or barter your cards with other cards, rather than using money.

How to Collect Credit Cards

When it comes to collecting vintage or expired credit cards, there isn’t a universal set of rules. The hobby is a highly specialized niche and is still quite new. Relatively few people have a real desire for it (which means there are all the more for us!), and those who are truly passionate have collected thousands of credit cards.

When it comes to collecting vintage or expired credit cards, there isn’t a universal set of rules. The hobby is a highly specialized niche and is still quite new. Relatively few people have a real desire for it (which means there are all the more for us!), and those who are truly passionate have collected thousands of credit cards.

While there aren’t any set rules, you can follow some tips and best practices from long-term collectors. You can also take to the internet and unearth informative articles, or join a club related to the hobby (like the ACCCS) and follow its general guidelines for collecting. Most of the time, though, credit card collecting is all about commitment, research, curiosity, and opportunism.

How to Get Started Collecting Expired Credit Cards

The best way to start your credit card collecting hobby is to use what you already have, while keeping an eye out for ones that are readily accessible. For example, instead of cutting or throwing away your old expired credit cards, you could start collecting them. You could also ask friends, relatives, and colleagues to give you their expired cards.

The more credit cards you collect, the easier it will be to narrow down your interests and figure out which types of cards you’re most interested in collecting.

How to Find Collectible Credit Cards

Once you’ve learned the important basics of the credit card collecting hobby, and established your preferences, you can start buying specific collectible credit cards on auction websites like eBay. Just make sure to look at reviews so you know the seller is credible. Alternative options are mentioned on our resources page.

You could also join social media groups or online forums that focus on your area of interest. This will allow you to participate in discussions, make connections, and get information on where to find certain cards. Trading with other collectors is also a great way to find collectible credit cards.

Another thing that you can do is to join a hobbyist club that’s related to your interest (we’d love you to join us!). This is a good opportunity to establish your network of friends and learn more about the hobby.

How to Organize Your Credit Cards

Some serious credit card collecting hobbyists have amassed thousands of cards. To stay on top of this kind of inventory, you need to be systematic and organized as your hobby grows.

You can use categories to organize the credit cards you collect. For example, you could group them together based on expiration year, issuers, or card types. Alternatively, you could store them alphabetically based on the surnames on the cards. Find or invent a system that works best for your purpose.

Using folders with plastic inserts (normally designed for collecting sports cards) keeps your credit cards organized and easy to look at, and some collectors even have their cards framed.

If you want to expand your credit card collecting hobby, learn more, and befriend like-minded people, become a member of the ACCCS.